In the business world, financial obstacles are inevitable, yet they do not have to hinder growth. Instead, with the right strategies, businesses can turn these challenges into stepping stones for long-term success. No matter its size, every company will encounter financial roadblocks—from cash flow issues to securing funding or managing debt. The key is to navigate these obstacles strategically, maintain a proactive mindset, and leverage resources effectively to propel the business forward. With the right tools and mindset, companies can overcome financial difficulties and emerge more muscular, with the foundation for sustained growth.

Gaining Insight into Financial Performance

Understanding the business’s economic health is the first step in overcoming any financial obstacle. To do so, it is crucial to regularly review key financial statements, such as the balance sheet, income statement, and cash flow report. These documents provide an accurate picture of a company’s performance, highlighting areas of strength and identifying weaknesses that need addressing. By clearly understanding the company’s finances, leaders can make informed decisions aligned with both short-term and long-term business goals.

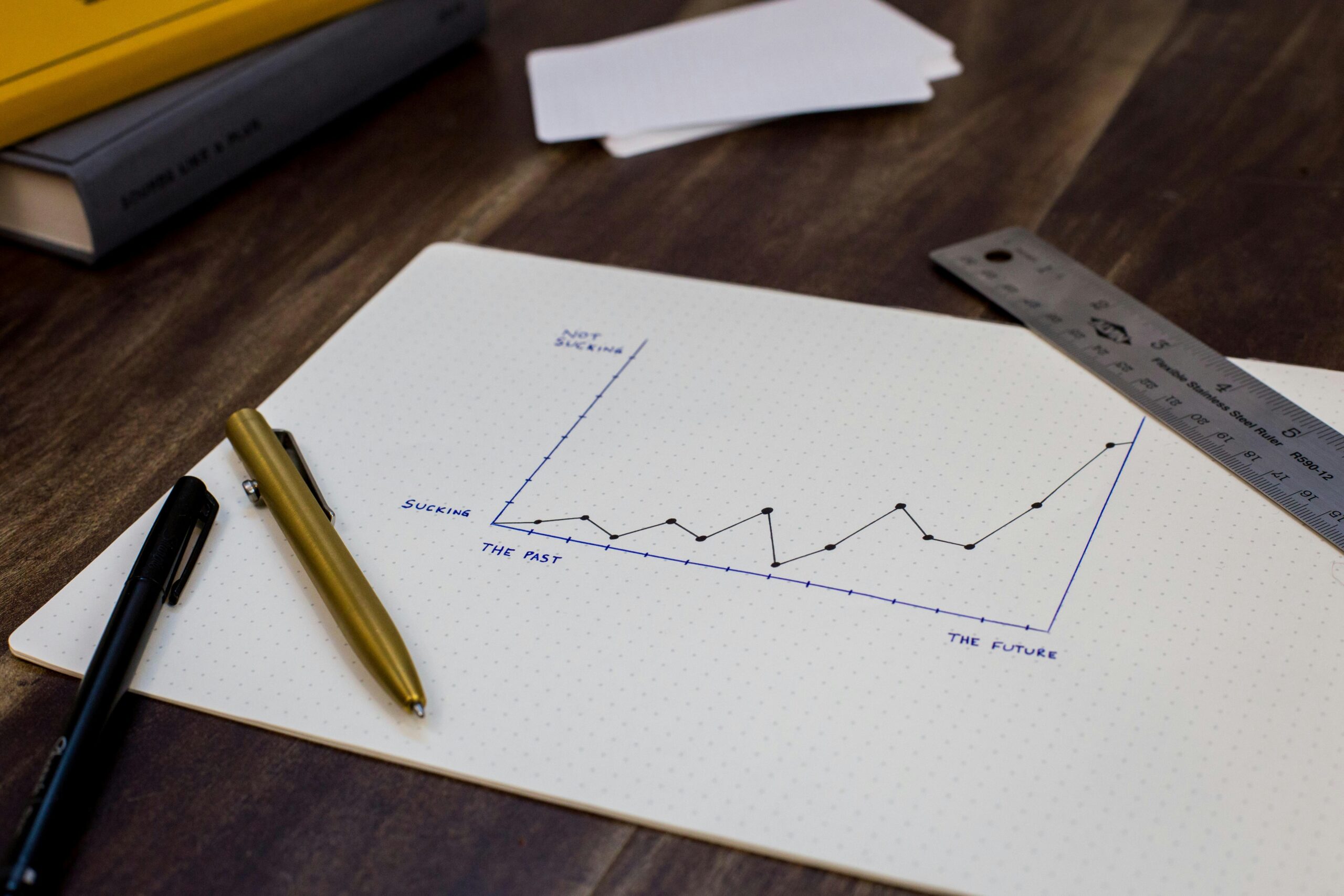

Beyond understanding current financials, gaining insight into performance trends is also crucial. Identifying patterns—whether in revenue, expenses, or market fluctuations—allows businesses to prepare for future changes and adapt to challenges. A company that tracks its financial progress over time can anticipate potential obstacles and take proactive steps to address them before they affect operations. This awareness helps leaders adjust strategies, allocate resources more effectively, and stay ahead of the competition, ensuring financial challenges do not derail growth efforts.

Effective Cash Flow Management for Business Longevity

Cash flow is the lifeblood of any business, and its management is a significant hurdle for many organizations. Even profitable companies can struggle if cash flow isn’t carefully managed. Issues such as slow-paying customers or unexpected operational expenses can create cash flow gaps, leaving a business without the liquidity needed to maintain daily operations or invest in new opportunities. Understanding this, business leaders must prioritize cash flow management by regularly tracking income and expenses to prevent disruptions.

Optimizing cash flow requires businesses to monitor accounts receivable and accounts payable closely. Encouraging prompt customer payments and negotiating better terms with suppliers are effective strategies to ensure smooth cash flow. Additionally, businesses can explore options like invoice factoring or short-term loans to bridge gaps during lean periods. Managing cash flow efficiently provides the financial stability necessary for growth, allowing businesses to capitalize on opportunities and mitigate risks without the constant stress of liquidity concerns.

Finding and Securing Capital for Growth Initiatives

Every business, especially those aiming for expansion, needs capital. However, securing funding often presents a significant challenge. Traditional lending routes, such as bank loans, may not always be feasible, particularly for newer businesses or those with limited credit history. As a result, seeking alternative funding sources, such as venture capital, angel investors, crowdfunding, or government grants, may be essential. While each funding option comes with its own set of requirements and expectations, it is necessary for business owners to carefully consider which approach best aligns with their goals and financial situation.

When seeking funding, businesses must be prepared to present a solid case to investors or lenders. A comprehensive business plan that includes financial projections, growth strategies, and market analysis will instill confidence in potential investors or financiers. Transparency about how the funds will be used is also critical. With a well-prepared and compelling pitch, businesses can secure the capital to drive growth initiatives, innovate, and expand into new markets. The proper funding at the right time can provide the resources necessary for a business to thrive in a competitive landscape.

Building a Robust Risk Management Framework

Risk is an inherent part of business, and navigating financial challenges requires understanding the company’s various risks. Economic risks can stem from several factors, including market fluctuations, changing regulations, and operational inefficiencies. To safeguard against these risks, businesses must implement a robust risk management framework that helps identify and mitigate potential threats. This might involve diversifying investments, hedging against market changes, or ensuring insurance coverage for unforeseen events.

By proactively managing risks, businesses can reduce their exposure to negative financial impacts. For example, diversifying revenue streams can protect against downturns in a single market or product line. Similarly, hedging against currency fluctuations or interest rate changes can stabilize volatile markets. An effective risk management strategy helps avoid financial setbacks and builds resilience, ensuring that the business is prepared to face future challenges head-on without compromising growth.

Improving Operational Efficiency for Cost Control

Optimizing business operations is one of the most effective ways to overcome financial challenges. By improving operational efficiency, businesses can reduce unnecessary costs and improve profitability, ultimately contributing to growth. Streamlining internal processes, automating tasks, and reducing waste can minimize expenses while maintaining productivity. For instance, businesses may use technology to automate routine administrative tasks, freeing time for employees to focus on high-value activities that drive revenue.

Additionally, businesses should regularly evaluate their supply chain and vendor relationships to identify opportunities for cost savings. Negotiating better terms, consolidating orders, or finding more affordable suppliers can help businesses lower operating costs without sacrificing quality. By making operational improvements and optimizing processes, companies can free up capital for reinvestment into areas that will fuel growth, such as research and development or marketing. Effective cost control and efficiency improvements lay the foundation for long-term profitability and financial health.

Building a Strong Financial Team to Drive Strategic Growth

Behind every successful financial strategy is a team of knowledgeable professionals who understand the intricacies of managing finances. Building a strong economic team is critical for navigating financial challenges and driving growth. A skilled finance team can provide insights into cash flow management, budgeting, forecasting, and risk assessment. They play a vital role in developing and executing strategies that will guide the business toward achieving its growth objectives.

A strong financial team doesn’t just focus on managing current finances—it also plays a key role in identifying future opportunities and planning for long-term success. This means collaborating closely with other departments to align financial strategies with overall business goals. Regular communication between the finance team and other leaders ensures that the company’s financial health is continually assessed and adjustments are made to stay on track. With a capable team, businesses are better equipped to navigate financial hurdles and position themselves for sustainable growth.

Financial obstacles are an inevitable part of any business journey, but they do not have to hinder growth. By focusing on understanding financial performance, managing cash flow, securing capital, mitigating risks, optimizing operations, and building a strong economic team, businesses can overcome these challenges and continue on their growth trajectory. Businesses that address financial hurdles head-on and turn them into opportunities for improvement are better positioned to succeed in an increasingly competitive marketplace. With the right strategies and a proactive approach, businesses can master financial obstacles and accelerate their growth.